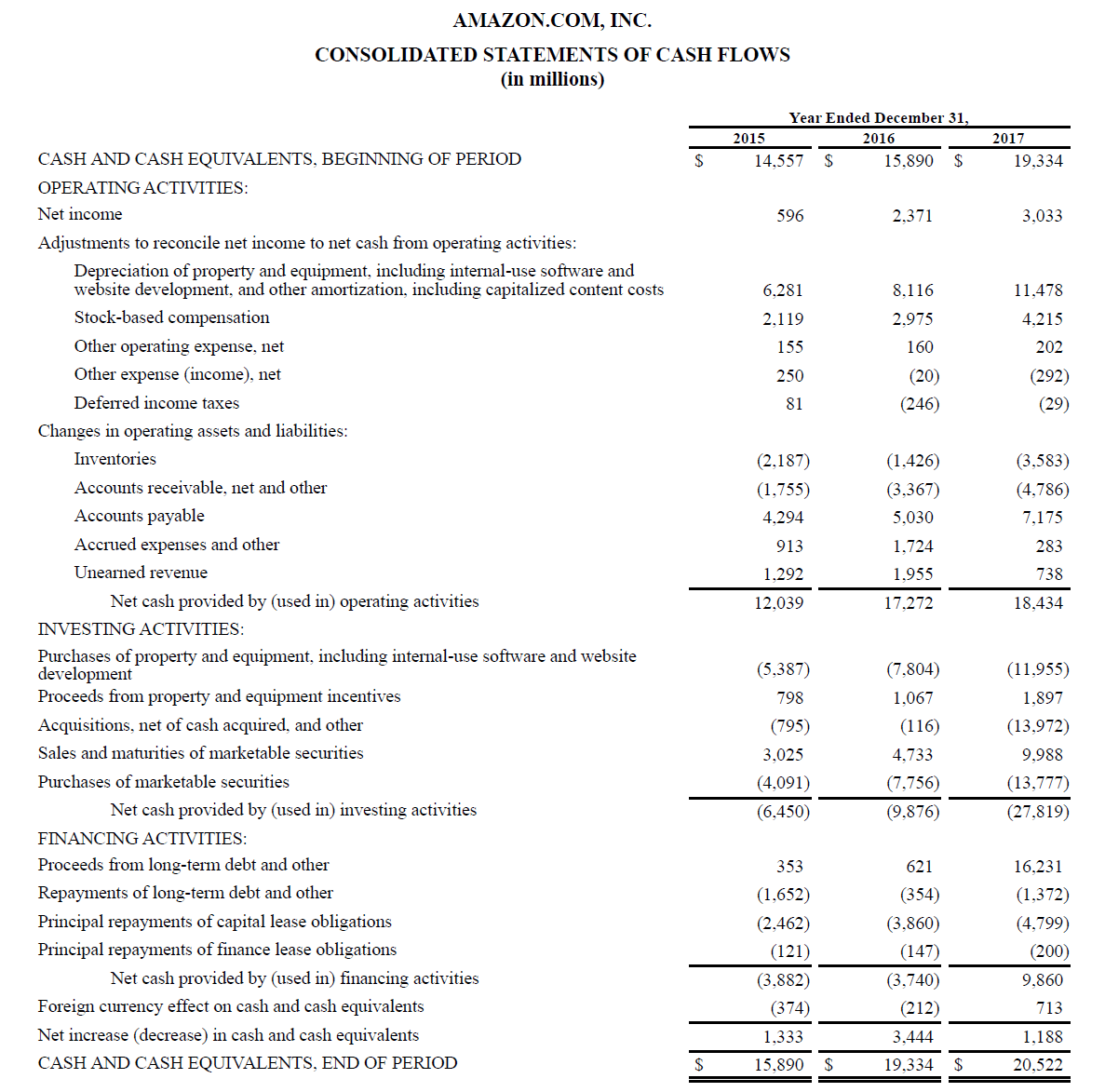

It is an essential document for evaluating the sources and uses of cash for an organization. It is especially important for deriving a business valuation, since many valuation methods are based on a firm’s net cash flows. The cash flow statement paints a picture as to how a company’s operations are running, where its money comes from, and how money is being spent. Also known as the statement of cash flows, the CFS helps its creditors determine how much cash is available (referred to as liquidity) for the company to fund its operating expenses and pay down its debts.

Get in Touch With a Financial Advisor

It also helps investors and creditors assess the financial health of the company. The changes in the value of cash balance due to fluctuations in foreign currency exchange rates amount to $143 million. Thus, when a company issues a bond to the public, the company receives cash financing. your taxable income In contrast, when interest is given to bondholders, the company decreases its cash. Transactions in CFF typically involve debt, equity, dividends, and stock repurchases. Cash-out items are those changes caused by the purchase of new equipment, buildings, or marketable securities.

Reviewed by Subject Matter Experts

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. But as you become more familiar with the language of financial statements it may become easier to make sense of them. As you can see from this dialogue, the statement of cash flows is not only a reporting requirement for most companies, it is also a useful tool for analytical and planning purposes.

Would you prefer to work with a financial professional remotely or in-person?

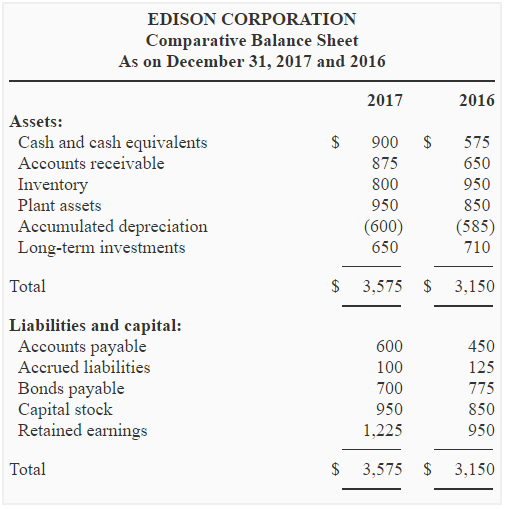

Phantom’s most recent balance sheet, income statement, and other important information for 2012 are presented in the following. The income statement for Home Store, Inc., shows $24,000 in depreciation expense for the year. As shown previously, this amount is added back to the net income of $124,000.

In these cases, revenue is recognized when it is earned rather than when it is received. This causes a disconnect between net income and actual cash flow because not all transactions in net income on the income statement involve actual cash items. Therefore, certain items must be reevaluated when calculating cash flow from operations. Under IFRS, there are two allowable ways of presenting interest expense or income in the cash flow statement.

- However, it does not measure the efficiency of the business in comparison to a similar industry.

- Next, changes in operational assets and liabilities are used to continue reconciling net income to actual cash flow.

- Free cash flow is the available cash after subtracting capital expenditures.

- If the company is consistently issuing new stock or taking out debt, it might be an unattractive investment opportunity.

- To opt-in for investor email alerts, please enter your email address in the field and select at least one alert option.

- Large, mature companies with limited growth prospects often decide to maximize shareholder value by returning capital to investors in the form of dividends.

This step is crucial because it reveals how much cash a company generated from its operations. This method measures only the cash received, typically from customers, and the cash payments made, such as to suppliers. These inflows and outflows are then calculated to arrive at the net cash flow.

Note that if there were any dividends issued to shareholders, the amount paid out would come out of retained earnings. You can also learn whether it is generating enough cash to not only cover its liabilities but also return money to shareholders via dividends or share buybacks. Marketable securities are things like short-term bonds and money market funds that the company buys to gain interest on its cash reserves.

As a result, the amount will be shown in the financing section of the SCF as (110,000). The underlying principles in ASC 230 (statement of cash flows) seem straightforward. Cash flows are classified as either operating, financing or investing activities depending on their nature.