When a company announces the repurchase of stocks, it often causes the share price to increase, which is perceived by the market as a positive outcome. The company then simply proceeds to purchase shares as other investors would on the market. When the market is not performing well, the company’s stock may be undervalued – buying back the shares will usually boost the share price and benefit the remaining shareholders. The repurchase action lowers the number of outstanding shares, therefore, increasing the value of the remaining shareholders’ interest in the company.

Would you prefer to work with a financial professional remotely or in-person?

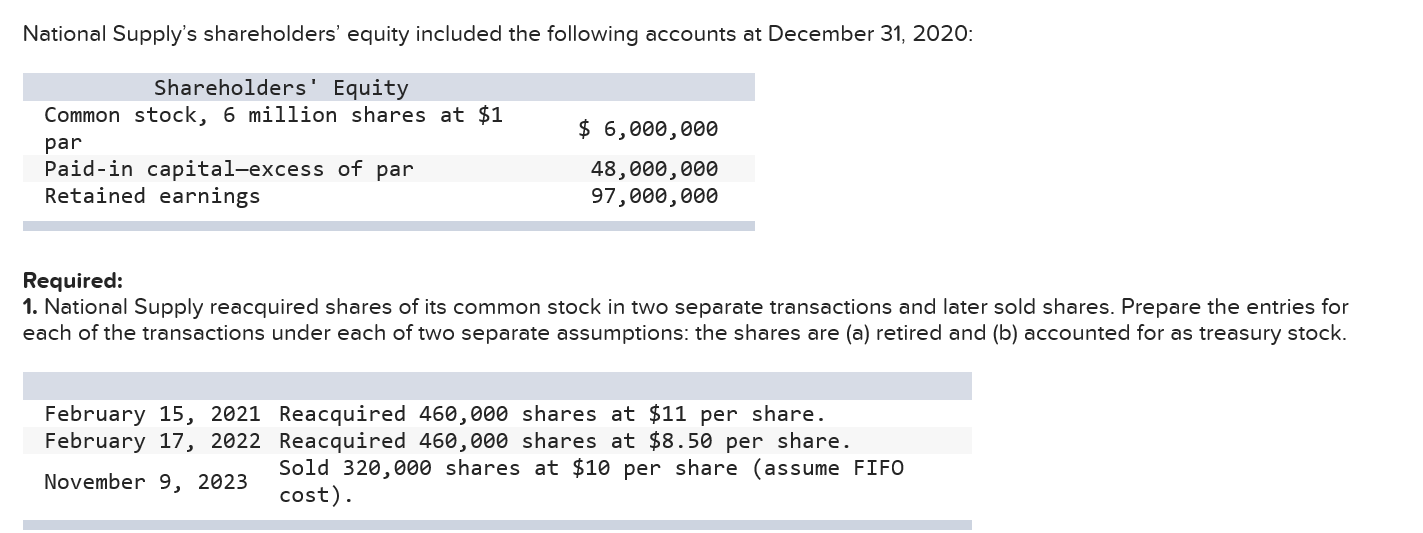

Retired securities have been repurchased by the issuer out of the company’s retained earnings and canceled, according to Securities and Exchange Commission (SEC) regulations. They have no market value and no longer represent a share of ownership in the issuing corporation. After that, the par value of shares plus the original share issue amount obtained from investors gets ignored. When shares are repurchased, they may either be canceled or held for reissue.

Conclusion: Why treasury stock matters to investors

Treasury stocks that are retired or canceled are also known as terminated stocks or canceled stocks. Therefore, retired shares mean the outstanding shares of a company that have been repurchased by the company after the shares have been issued, and then subsequently cancel the repurchased shares. Treasury stock is considered a contra-equity account, meaning it reduces the overall equity value. For instance, when a company repurchases shares, the cost of those shares is debited from the treasury stock account, and the cash account is credited for the amount paid. Under the par value method, the treasury stock account is debited to decrease total shareholders’ equity at the time of share repurchase. This is done in the amount of the par value of the shares being repurchased.

- In a buyback, a company buys its own shares directly from the market or offers its shareholders the option of tendering their shares directly to the company at a fixed price.

- Additionally, the reduction in the number of shares can increase existing shareholders’ ownership stake.

- Hence, the SEC issued necessary procedures and guidelines regarding the cancellation, destruction, or storage of canceled certificates of firms to prevent fraudulent trades.

- ABC Company has excess cash and believes its stock trades below its intrinsic value.

- These considerations can help the Company avoid setting a high buyback price for the market.

- He helped launch DiscoverCard as one of the company’s first merchant sales reps.

How are shares acquired through special purchases?

In the United States, the Securities and Exchange Commission (SEC) governs buybacks. When the number of shares repurchased reaches 2% of the total number of issued shares or the amount reaches NT$300 million, the company must immediately make an announcement! Therefore, during the buyback period, the company has to keep reporting the progress to the outside world so that everyone can keep up with the latest developments of the treasury shares! When a company announces a treasury stock buyback plan, the market often views it as positive news, interpreting it as a sign that the stock is undervalued.

After buyback

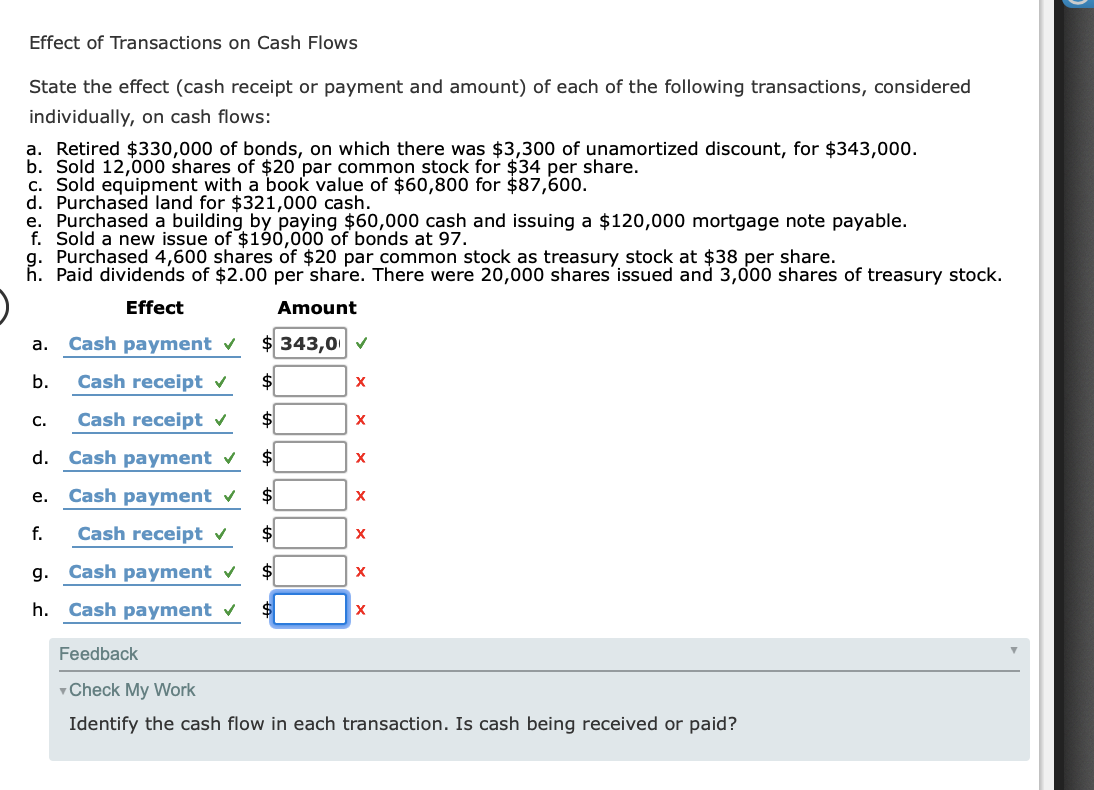

This treatment aligns with the idea that treasury stock represents a withdrawal of capital from shareholders. By contrast, under the par value method, share buybacks are recorded by debiting the treasury stock account by the shares’ total par value. Under the cost method, the more common approach, the repurchase of shares is recorded by debiting the treasury stock account by the cost of purchase. When a company buys back its own shares, such shares are classified as treasury stock. The example below shows the retirement of treasury shares journal entry using the cost method.

Technically, a repurchased share is a company’s own share that has been bought back after having been issued and fully paid. Treasury stock accounting may vary slightly depending on the method used to record the repurchase, either by the cost method or the par value method, but in both cases, the transaction reduces total equity. One of the main reasons companies repurchase shares is to increase the value of the remaining shares. By reducing the number of outstanding shares, each remaining share becomes more valuable, often leading to a higher stock price. These shares are issued by the company to the public and provide shareholders with ownership in the company, voting rights on corporate matters, and eligibility to receive dividends.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and what is considered an adjustment to income market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

While reducing the number of shares available to investors may seem counterintuitive, this decision often aligns with a company’s broader goals to improve shareholder value and strengthen its financial structure. Once a company has completed its share buyback, it can retire those shares, hold them for release back into the market at a future date, or provide them to employees as a form of compensation. A buyback comes with both pros and cons, and as an investor it’s important to understand why a company is buying back its shares and how that affects its value for the long-term, allowing you as an investor to make prudent investment choices.